Do you know what would happen to your business if you were to retire next week? What would happen to the business if you become incapacitated or passed away suddenly? Without a business succession plan, your heirs and your business may be thrown into chaos. As you continue to focus on growing your business and making it a success, you should also discuss, with a Wisconsin business succession lawyer, how you intend to wind the business down or transfer the business.

Seven Important Reasons to Develop a Business Succession Plan Now

- You want to control which family members take control of the business.

In a family-owned and operated business, your business interest may not automatically pass to the person you want to continue operating the business. To ensure the business is transferred to the correct family member or members, your business succession plan should be developed in close conjunction with your estate plan. - You want to have the freedom to exit the business.

A business succession plan provides you with a sound exit strategy whenever you are ready to sell the business or retire. A plan should include language that outlines how you will be compensated for your interest in the business if you leave. The provisions in the plan may require the other owners to “buy out” your interest or continue paying you compensation even after retirement. - To plan for your incapacitation.

While you hope to remain active and healthy, an accident or illness could result in incapacitation. Your business succession plan should include specific language and terms related to an owner’s incapacitation. You may want to appoint someone as your proxy to act on your behalf to make business decisions until a transition of authority can be made smoothly. - A blueprint for closing and liquidating the business.

You may not want your business to continue without you. Therefore, you need a plan for closing the business upon your retirement, death, or incapacitation. The plan should be very clear whether the business may be sold as a going concern or whether the business should be closed, and the assets liquidated. - Tax Considerations

The route you take to exit your business and the type of business you own are factors in the amount of tax you may owe when transferring or closing the business. You should work closely with your Wisconsin business succession attorney to create an estate plan and a business succession plan that minimizes your tax liability and the tax liability of your estate and your family. - Selling your business to insiders.

You may want to limit who can purchase your business if you decide to leave the business. Some business owners want to limit the potential buyers to key employees within the business or transfer the business to employees through an ESOP (Employee Stock Ownership Plan). If the employees do not want to purchase the business, your succession plan should provide for a contingency, such as closing the business or transferring the business to a relative. - Train Your Successor

When you choose a successor and formulate a business succession plan now rather than later, you have more time to train your successor. In addition, your plan allows you to choose a successor who may not have all the skills or requirements to take over the business yet, but with the proper training, he or she will be ready when you exit the business.

Contact a Wisconsin Business Succession Lawyer

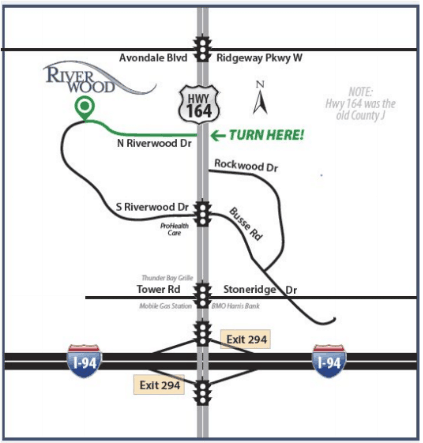

To avoid conflict and ensure a smooth transition, you need to develop a business succession plan. Contact the business succession attorneys at Riverwood Legal & Accounting Services, S.C., today so they can guide you through each step in developing a plan that meets your needs and accomplishes your goals.