Milwaukee & Waukesha Estate Planning Attorneys

Estate Planning with Wills & Trusts / Estate Asset Protection

Making plans for when you pass away can be emotionally and mentally difficult. Many people avoid thinking about this issue altogether, and unfortunately don’t put a legally binding estate plan in place that both honors their wishes and spares their loved ones additional expenses and stress while they grieve.

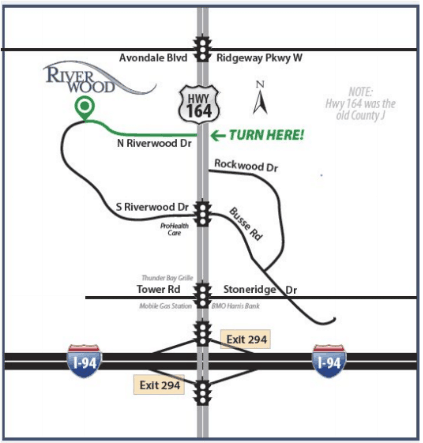

At Riverwood Legal & Accounting Services, S.C. in Waukesha, we offer a free initial consultation for you, and if you choose, your loved ones, to come in to talk about matters with us that can include:

- Will Planning

- Crisis Planning

- Estate Plans

- Power of Attorney

- Guardianships &

- More

Should you decide to move forward with us, we, as your trust administration attorneys, can then custom-craft a written legal plan for the efficient management and distribution of your assets, both during your lifetime and after death, that minimizes the taxes and maximizes wealth transfer to your heirs.

Protect Your Heirs: Estate Tax Planning

Dying without a will is referred to as “dying intestate” which leaves you without a say on who receives your assets, and can also be expensive to your heirs. We pride ourselves on listening to your concerns and unique situation in these matters, and then evaluating your needs to help you make the right decision for you and your family. Don’t leave your family guessing.

Will or Trust: What is Right for Me?

The correct answer for you depends on the type of assets you own, your desire to control those assets before death, and the level of asset protection (from immaturity, chemical dependency, divorce and/ or creditors) needed for your family after your death.

When we meet, we will talk about your wishes to get a detailed understanding of these and of your family circumstances. We will then evaluate and recommend the right course of action for you to proceed in the handling of your assets. Let our experienced attorneys help evaluate your wishes and determine the best solution for you.

Estate Plans

Developing an estate plan gives you the power to decide who will make your medical and financial decisions should you become unable to do so. Most estate plans are made up of a will and/or a trust, a health care power of attorney, and a financial power of attorney to care for these matters according to your wishes.

Trusts

A trust is legally binding, and lets you determine the way your assets will be distributed to your heirs when you pass without the expenses, delays, potential disagreements, and publicity of going to probate. You will still need a will to handle your assets held outside of the trust.

Fixed Fee Basis

Riverwood offers you flat fee pricing on most of our estate planning offerings, with no surprises or additional unexpected costs. We can work within your budget to provide critical guidance and peace of mind knowing that your plan is properly prepared.

Call Riverwood Legal and Accounting Services, S.C. to schedule your NO-COST consultation today at: